The Broadleaf succession method is deliberately long-term focused and customised to the speed chosen by the financial planning business owner. By harnessing the collective experience of the Broadleaf community, your succession plan enables your firm to grow and remain resilient. Owners, advisers, employees and clients benefit from the unique Broadleaf succession solution that preserves the characteristics and values of your firm by combining current owner experience with well supported future leadership.

The Broadleaf process is customised to you and your business.

We want to build on your legacy in a way that works best for you. This means the foundations you have built remain as pillars of growth and success for all stakeholders including your employees and clients.

The strength of the Broadleaf group comes in the alignment of values and philosophies, enabling exceptional client experience and quality of advice. The Broadleaf process begins with getting to know you and your business and crafting together a customised succession plan.

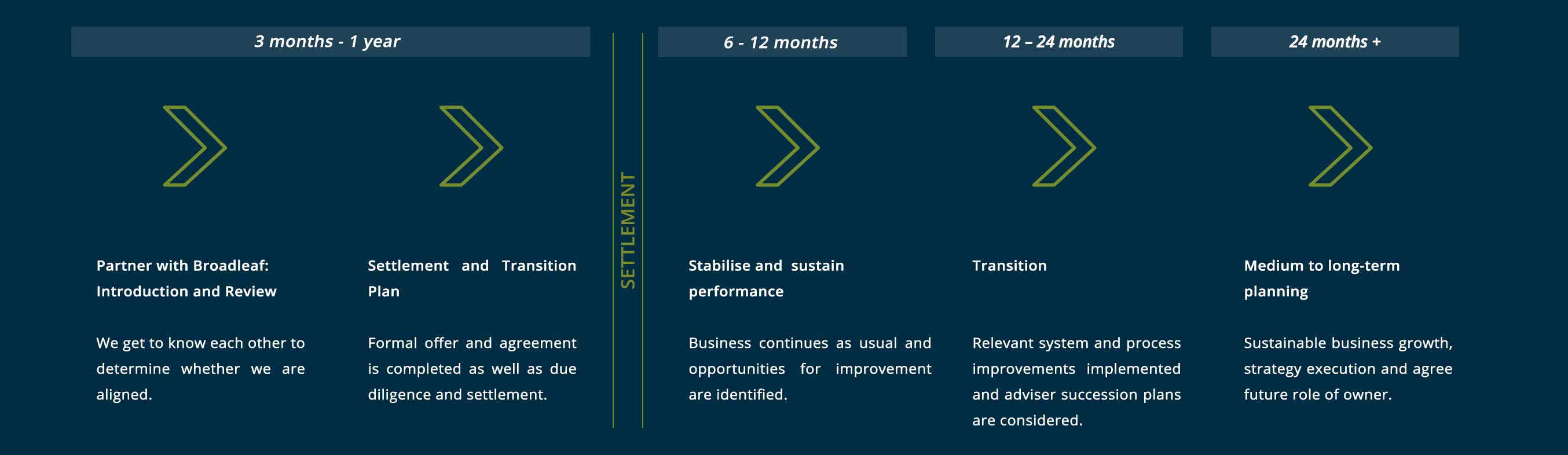

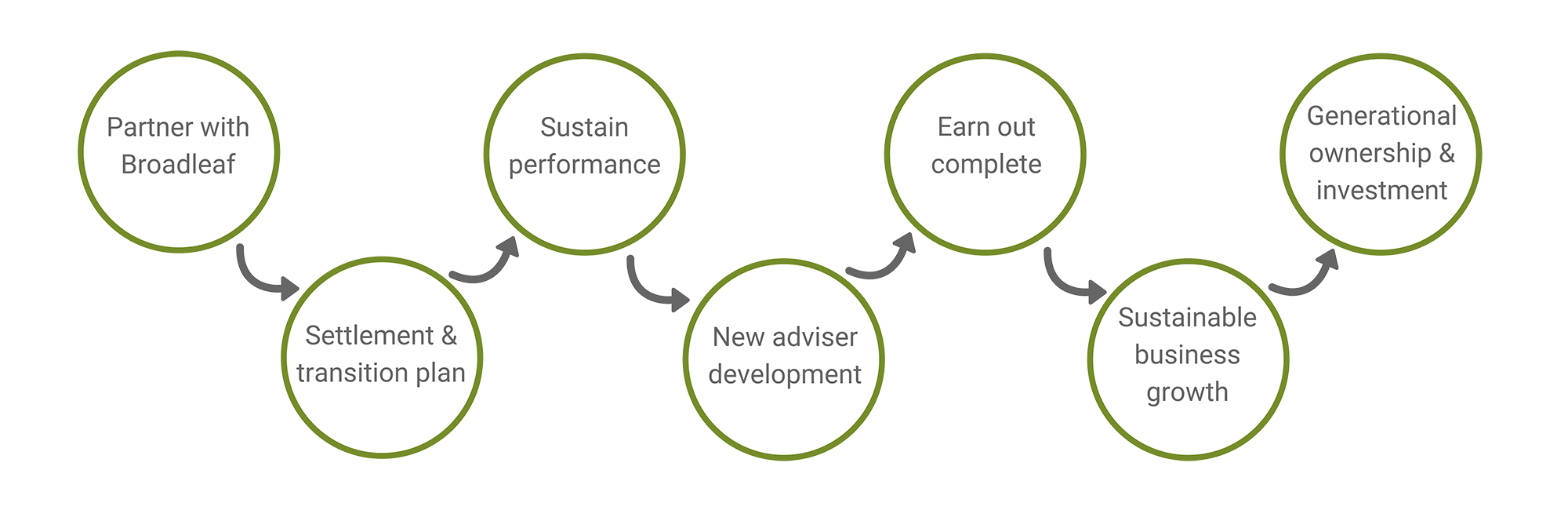

Broadleaf timeline for succession

Below is an example timeline of succession with Broadleaf.

Broadleaf resources to help

you plan your succession:

Mapping your succession path

Identify what it is you want from your succession using the Broadleaf questionnaire developed for financial planning business owners and founders.

Business Resilience Assessment

This resource helps you determine the resilience of your business as it currently stands.